メデュラヘアマスク

(税込) 送料込み

商品の説明

種類···トリートメント/ヘアパック

香り:Light

パッケージ撮影のために箱からは取り出してしまってますが未使用ですので御安心ください!

本体/詰め替え···本体商品の情報

| カテゴリー | コスメ・美容 > ヘアケア > リンス・コンディショナー |

|---|---|

| ブランド | メデュラ |

| 商品の状態 | 新品、未使用 |

メデュラ(MEDULLA) / パーソナライズヘアマスク ORIENTAL(ジャータイプ

メデュラ(MEDULLA) / パーソナライズヘアマスク LIGHT(ジャータイプ)の

メデュラ(MEDULLA) / パーソナライズヘアマスク OCEAN(ジャータイプ)の

メデュラ(MEDULLA) / パーソナライズヘアマスク FLOWER(チューブタイプ

MEDULLA メデュラ パーソナライズ ヘアマスク - トリートメント

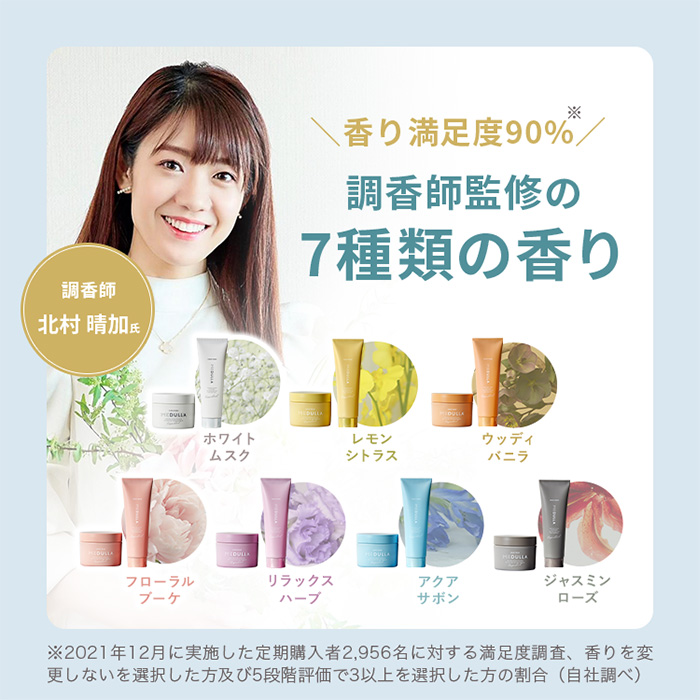

悪い口コミ・評判】効果ない?メデュラヘアマスクくせ毛が使ってみた

メデュラ 頭皮用トリートメント2箱とヘアマスク2箱160g1回の使用量

メデュラ パーソナライズヘアマスク - 基礎化粧品

メデュラ パーソナライズヘアマスク - 基礎化粧品

悪い口コミ・評判】効果ない?メデュラヘアマスクくせ毛が使ってみた

悪い口コミ・評判】効果ない?メデュラヘアマスクくせ毛が使ってみた

メデュラ medulla ヘアマスク ヘアトリートメント LIGHT

MEDULLA ヘアマスク トリートメント メデュラ ヘアケア 人気

メデュラヘアマスク - コンディショナー

MEDULLA メデュラ パーソナライズ ヘアマスク - トリートメント

メデュラ ヘアマスク - トリートメント

メデュラ medulla ヘアマスク ヘアトリートメント LIGHT

メデュラ ヘアマスク 4個セット - リンス・コンディショナー

【メデュラ パーソナライズヘアマスク】頭皮ケアにはこれで決まり👌

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

メデュラ medulla ヘアマスク ヘアトリートメント LIGHT

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

メデュラ(MEDULLA) / パーソナライズヘアマスク SUN(ジャータイプ)の

まとめ買いでお得 / 半額【新品未使用】メデュラ パーソナライズ

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

メデュラ ヘアマスク 4個セット - リンス・コンディショナー

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

悪い口コミ・評判】効果ない?メデュラヘアマスクくせ毛が使ってみた

メデュラ ヘアマスク 4個セット - リンス・コンディショナー

メデュラ(MEDULLA) / パーソナライズヘアマスク FLOWER(ジャータイプ

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

メデュラ MEDULLA ヘアマスク OCEAN 2個セット - ヘアパック/ヘアマスク

ドンキや市販で買える?】メデュラヘアマスクの販売店舗を調査!Amazon

楽天市場】【LINE登録で300円OFFクーポン】MEDULLA(メデュラ

MEDULLA(メデュラ) on X:

悪い口コミ・評判】効果ない?メデュラヘアマスクくせ毛が使ってみた

MEDULLA メデュラ ヘアマスク セット 頭皮用トリートメント

ジャーのみ作成中MEDULLA☆セミパーソナライズが登場☆ヘアマスク 髪質

MEDULLA メデュラ パーソナライズ ヘアマスク - トリートメント

MEDULLA(メデュラ) パーソナライズヘアマスクの悪い口コミ・評判は

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています