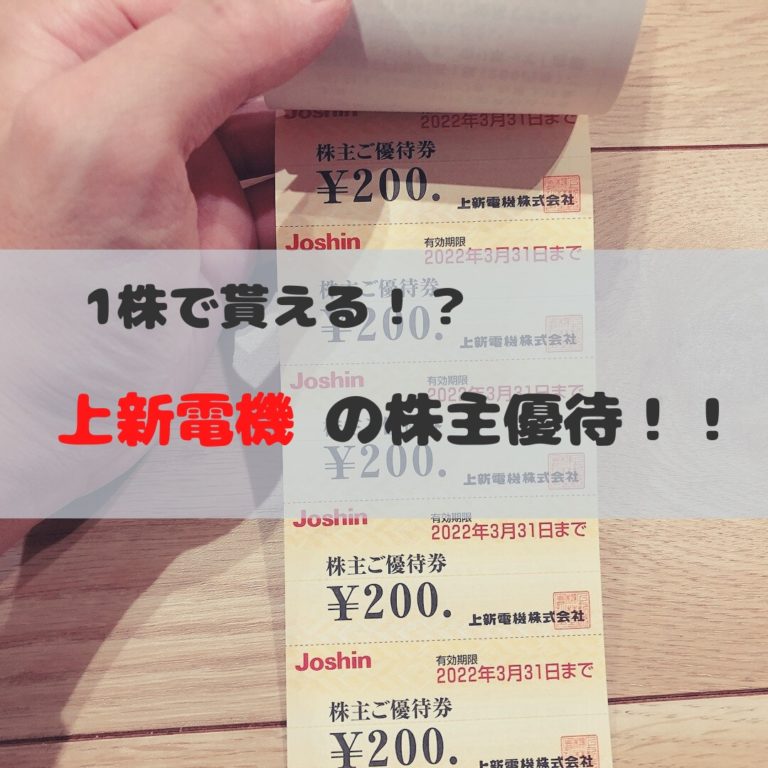

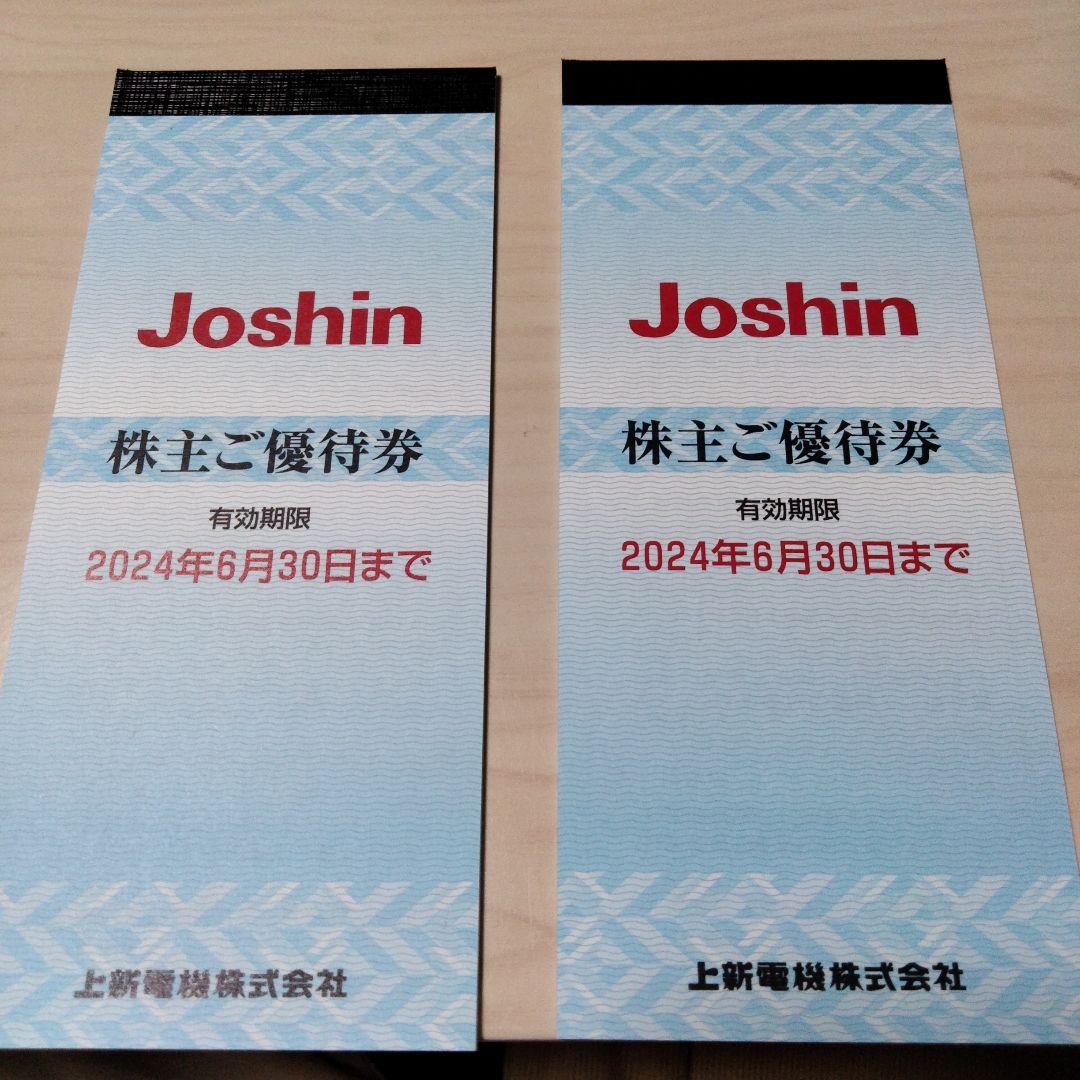

Joshin Joshin電気 株主優待券

(税込) 送料込み

商品の説明

Joshinの分です。

毎に1枚利用可能です。

×25枚

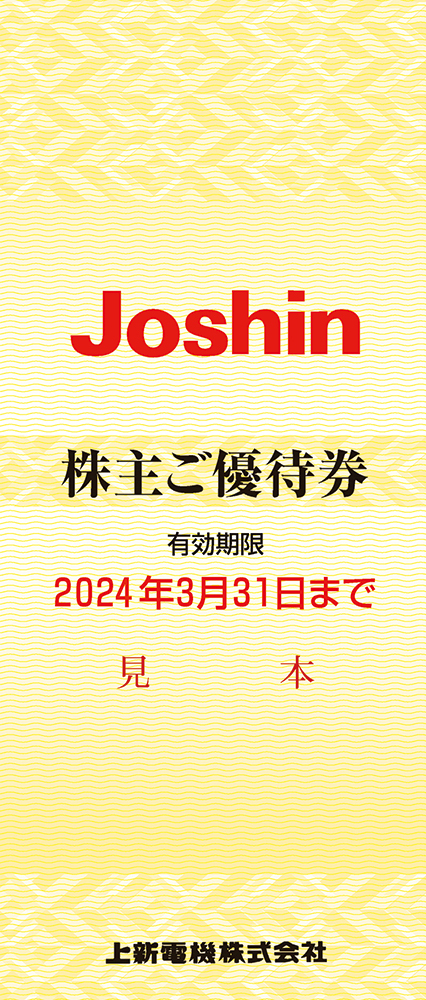

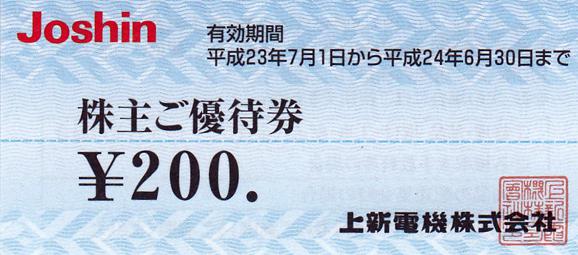

有効期限・2024年3月31日有効期限です。商品の情報

| カテゴリー | チケット > 株主優待券・割引券 > ショッピング |

|---|---|

| 商品の状態 | 新品、未使用 |

Joshin 上新電機 株主優待券 5000円分(200円×25枚) - ショッピング

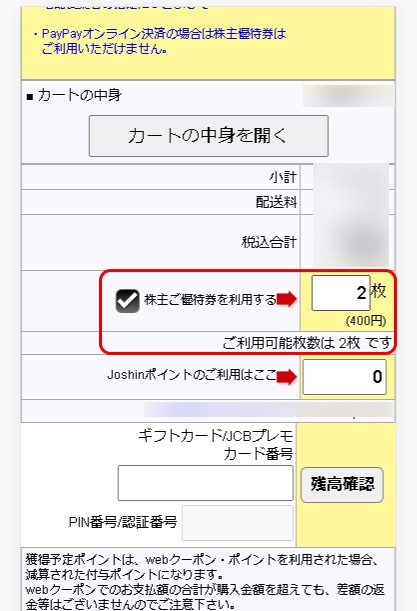

株主優待券は、Joshin webでもお使いいただけます

上新電機(8173)の株主優待紹介

上新電機 株主優待 5000円 Joshin クーポン ジョーシン ① - ショッピング

上新電機 Joshin 優待 5000円分 - その他

安全保証付き ジョーシン 上新電機 株主優待券 5冊(25000円分) | www

上新電機(Joshin)株主優待券の高価買取なら金券ショップへ|金券

Joshin 上新電機 株主優待券 - ショッピング

受注発注 johsin 上新電機 T-ポイント5倍 最新 Joshin ジョーシン

包装無料/送料無料 Joshin 上新電機 Joshin 分- ジョーシン 分 株主

Joshin 上新電機株式会社株主優待券 - ショッピング

品質保証 Joshin ジョーシン ショッピング ジョーシン 上新電機株式

在庫処分セール 【10,000円分】上新電機 株主優待 ジョーシン 優待 上

Joshin 上新電機 株主優待 5冊 25,000円 - ショッピング

Joshin 上新電機株主優待券 5000円 - 割引券

55%以上節約 上新電気 優待券/割引券 Joshin 株主優待券 2023年3月31

ジョーシン Joshin 上新電機 株主優待券 5000円分 - ショッピング

柔らかい □Joshin□上新電機□株主優待券□分□ 割引券 優待券/割引券

株主優待 | 株式情報 | IR情報 | 上新電機株式会社

上新電機株主優待券(200円)1枚 ~24年6月の購入はチケットオンラインで

好評につき延長! ジョーシンJOSHIN 上新電機 40000円分 株主優待券 36

上新電機 Joshin 株主優待 2200円 by メルカリ

株主優待券は、Joshin webでもお使いいただけます

Joshin 上新電機 株主優待 5000円分 - ショッピング

比較検索 ジョーシン Joshin 上新電機 株主優待券 分 | kodomo

素晴らしい品質 上新電機 Joshin ジョーシン 株主優待券 30000円

販売売筋品 ジョーシン Joshin 上新電機 株主優待券 分 | chanelal.com

2024年最新】上新電機 優待の人気アイテム - メルカリ

ジョーシン 上新電機 株主優待券 10000円分 - ショッピング

流行に joshin ジョーシン 上新電機 株主優待券 6冊 分 株主優待券

日本正規品 日本買付 Joshin 上新電機 株主優待券 4冊 株主優待券

店舗在庫あり Joshin 上新電機 株主優待券 分 匿名配送 | kodomo

Joshin 上新電機株主優待券5,000円分 - 割引券

トップ 上新電機 Joshin 上新電機 株主優待券 6冊セット 株主優待券

商品一覧 joshin 上新電機 ジョーシン 株主優待券 4冊 20,000円分

格安販売の Joshin 上新電機 株主優待優待券 4冊 2分 - 株主優待券・割引券

最新のデザイン ジョーシン 上新電機(ジョーシン 上新電機 ジョーシン

新入荷 ジョーシン - 上新電機 ジョーシン Joshin 上新電機 株主優待券

100%本物保証! ジョーシン Joshin 上新電機 上新電機株式会社株主

独特の素材 株主優待 5000円×2冊の+canalvip.tv Joshin(ジョーシン

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています