ハンドメイド 水筒肩紐カバー 黒×ヒッコリー タグ付き

(税込) 送料込み

商品の説明

⭐️まとめ買い機能に関しましては、プロフのご確認をお願いします( > > )

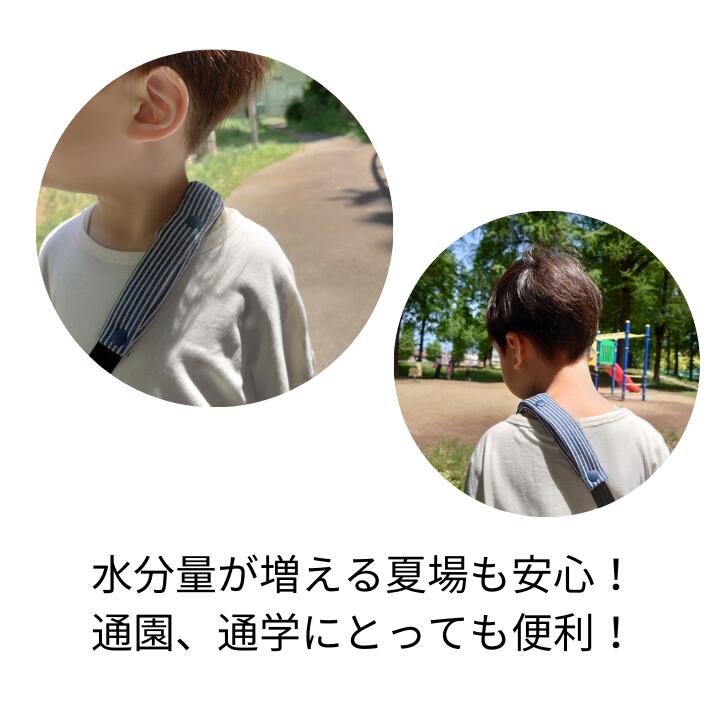

☆水筒肩紐カバーです( > > )

肩紐の首や肩への食い込みを抑えて、痛みを軽減します。

水筒の目印にもなります(o > > o)

紐が取り外せるタイプの水筒に使用できます!

水筒以外にも、書道セットや絵の具セットなども、肩紐が外せれば使用できます。

☆ご自宅使いはもちろん、プレゼント、入園、入学、新学期準備にもオススメです( > > )

〜サイズ〜

長さ・22〜23㎝

幅・6㎝〜6.5㎝

紐入れ口・4.5㎝〜5㎝

(多少の誤差はご了承下さいませm(._.)m)

☆ASHIATOYAさんのタグを使用しています。

☆肩にあたる部分はキルト生地、厚手キルト芯、キルト生地の3枚重ねにしてありますので、とてもふわふわで、しっかりしています!

表側はキルト生地、綿生地の2枚重ねになっています!

小学生の娘といろいろな長さ、厚みを試してみながら、使い心地のいい、このサイズ、厚みになりました(*´꒳`*)

個人差はあるかもしれませんが、カバーを使うようになってからは、痛がる事もなくなりました( > > )

☆おまとめの場合、2点目よりお値引きさせていただきます♡

ご購入後は、対応出来ません( ; ; )

☆素人のハンドメイド作品になりますので、サイズの誤差、ゆがみ、重ね縫いなど、至らぬ点もありますので、ご理解いただいた上でのご購入をよろしくお願い致します( > > )

バイアスに、小さな黒っぽい点のようなものがある事がございますが、購入時からのもので汚れではありません。

気にされる方はご購入をお控えくださいませm(__)m

☆他にも多数出品させて頂いております!是非ご覧くださいませ( > _-)

☆ひとつひとつ大切にお作りさせて頂きます(о´∀`о)

☆より見やすくするために、ハッシュタグ付けました!

こちらを開き→販売中を押していただきましたら、現在出品中のものが分かります( > > )

↓

#かわ出品一覧

#かわハンドメイド

#かわ水筒肩紐カバー商品の情報

| カテゴリー | ハンドメイド・手芸 > ベビー・キッズ > 手提げ・レッスンバッグ・入園グッズ |

|---|---|

| 商品の状態 | 新品、未使用 |

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - メルカリ

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - メルカリ

ハンドメイド 水筒肩紐カバー ダブルガーゼ 宇宙 - その他

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 星 黒 - ベビー

ハンドメイド 水筒肩紐カバー デニムネイビー×ヒッコリー タグ付き

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 星 グリーン - ベビー

ハンドメイド 水筒肩紐カバー 宇宙 黒 - ベビー

ハンドメイド 水筒肩紐カバー 銀河 黒×ヒッコリー - ベビー

筒形水筒カバー「ヒッコリー黒」底直径6.7用全長17ショルダー一

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

筒形水筒カバー「ヒッコリー黒」底直径6.7用全長17ショルダー一

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

約22㎝〉ネイビー星柄/ヒッコリー/水筒肩紐カバー/ハンドメイド

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー ヒッコリー×黒 - ベビー

SKATER水筒紐 黒 - パーツ

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

高級感 ハンドメイド*ポカリスエットボトルケース 水筒カバー

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 迷彩 グレー - ベビー

水筒ベルトカバー 紐カバー ハンドメイド中古品 - その他

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 宇宙 黒 - ベビー

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 迷彩 デニム - その他

水筒カバー1リットル用ファスナータイプ「ヒッコリー黒」本体と手さげつき

ハンドメイド 水筒肩紐カバー ダブルガーゼ 宇宙 - その他

楽天市場】筒肩紐カバー 水筒 紐カバー 水筒 肩 紐 カバー 1000円

ハンドメイド 水筒肩紐カバー 黒無地×ヒッコリー - ベビー

ハンドメイド 水筒肩紐カバー 星 黄×ヒッコリー - ベビー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています